It is revealing that that the term freelancer pairs free with lance. As mercenaries, freelancers in the Middle Ages were free of the missionary justifications that bound feudal lords and commoners to their intertwined societal fates, but they were still bound to the nature of their medium: the lance.

The lance was the medium of work and creative expression for the knightly class. Its message was death. And unburdened by any other sort of mission, freelancers were its clearest messengers.

In the Middle Ages, feudal knights were the messengers of capital (land for the most part), peasants were the messengers of community, and freelancers were the messengers of the most important technology of the day: the lance. Together, they sustained a three-way conversation between capital, community, and technology.

I think of this as the original Business Discourse. It is the conversation that happens around and within every business, from feudal manor to modern internet platform. It is like the Public Discourse on social media (often represented by the classic meme image of a chef), except for businesses.

The Business Discourse revolves around official statements by executives and employee groups, corporate PR statements, and “whistleblower” accounts and opinions leaked into the public discourse. Often it sparks storms in the public discourse too, but it is fundamentally a separate conversational theater.

Unlike the public kind, the business edition exists in a much more fragmented form, as a set of islands and archipelagos around individual businesses and sectors. But it does have its own gestalt. At any given time, there is a definite tone to conversations around businesses. This tone evolves gradually over time.

A particular small storm in the Business Discourse has been on my mind for the last few days: the publication of a blog post titled Coinbase is a Mission-Focused Company by Brian Armstrong, CEO of Coinbase, and the broad response to it.

The Business Discourse

The three-way partition of the Business Discourse, which emerged in the Middle Ages, continues to this day within every business.

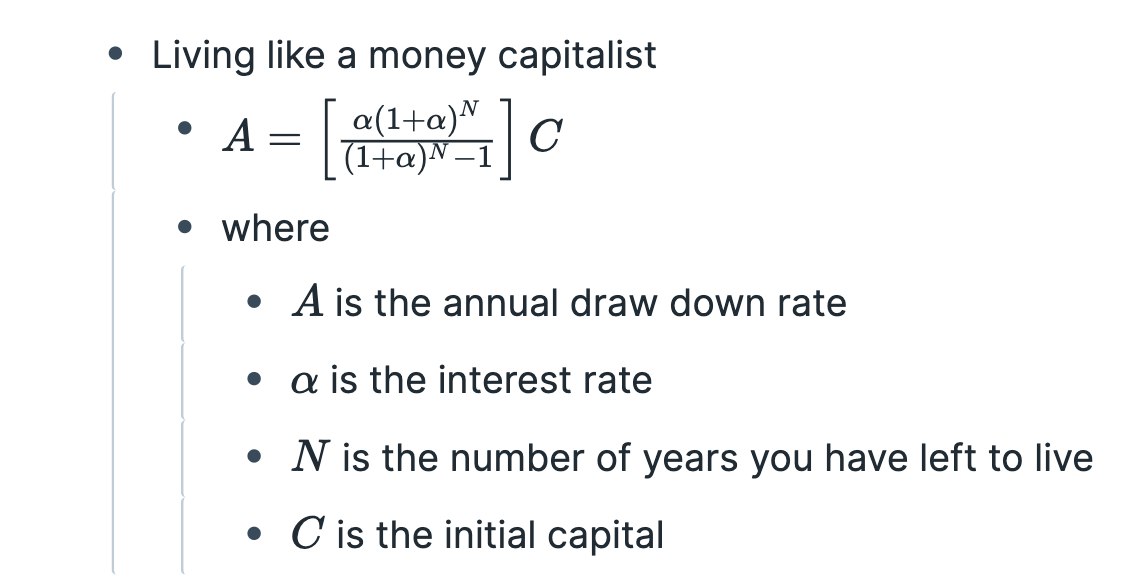

Today, executive management speaks for capital, paycheck employees speak for community, and gigworkers speak for the technological medium (more on that last one later, since it may not be as obvious as the other two).

Customers, non-employee shareholders, and the general public, though they have a stake in the actions of a business, are not directly involved in the conversation. Depending on the situation, they might end up siding with any of the three active parties.

The lines have gotten blurred somewhat since the early industrial age. With the rise of complex and broad forms of participation in equity, it is no longer very meaningful to talk of management and labor for example. But it is still meaningful to speak of the three core messages in the conversation, and their respective messengers.

Depending on whether your compensation is dominated by equity, paychecks, or gig income, you’ll typically (but not necessarily) tend to speak for capital, community, or medium.

Lately though, one of the three groups has begun to dominate the Business Discourse: employees. Employee activism around political issues has grown steadily over the last few years (I did a more general thread about it in June).

The results have been decidedly mixed. I actually suspect mixed feelings about employee activism is one of the more recent drivers of people opting into the gig-economy as a Third Way.

Employee Activism

Employee activism started out as a useful check and balance to executive power, which around 2014, in the wake of the recession, was increasingly growing beyond the ability of stock markets, customers, or politicians to regulate. Employee activism briefly played a useful role: helping focus a certain amount of useful attention on issues like climate change, and abuse of social media platforms.

But increasingly, employee activism is confused, economically illiterate, rife with grifts and political careerism, and often hurts the causes it pretends to be about.

The Coinbase kerfuffle apparently started (correct me if I’m wrong, I’m going by twitter gossip) with a group of employees wanting the company to make some sort of public statement in support of Black Lives Matter a few months ago. Armstrong apparently resisted the call, and the blog post lays out his the general principles behind his decision: the company has a clear but narrow mission, and he believes it should not get involved in political activism outside of issues with direct relevance to that narrow mission.

Faced with a backlash following his blog post, he has since doubled down firmly, offering employees who want a more expansive political agenda (and a bigger voice in shaping it) a generous severance package to leave. It is unclear how this will unfold.

While I’m user of the company’s services, I don’t know any of the principals here, and have no idea what sort of person Armstrong is, or whether I’d like him personally. As a user, I think the company does a good job with its product.

But I happen to believe he was right on this issue, and did a few short Twitter threads in the last couple of days about it.

In general, I believe well-run companies, unlike well-run nations, benefit from an element of authoritarianism in their leadership. It’s good to have leadership that listens sincerely to all stakeholders, and aspires to service in a broad sense, but ultimately owns the decisions, along with all attendant risks and consequences. That’s what executive means.

A business is not a democracy or a political party. A business leader who aspires to lead by the logic of some sort of democratic employee mandate, rather than by the logic of the offering and its market, will soon have no business left to run.

To the extent the nature and conduct of a business is an expression of politics, it is naturally and necessarily an expression of the politics of its key executives. Otherwise it will typically struggle. Rank and file employees have limited say, and this is as it should be.

For employees, the primary means of political expression lies in their choice of employment, not in what they get to do within it. If you are a militarist hawk, maybe work for Lockheed Martin. If you’re a pacifist, maybe work for a vegan foods company. If you’re a climate activist, maybe work for a renewables company. If you are a climate skeptic, go work for a coal-mining company. If you believe you can meaningfully alter the natural politics of a business from the inside, by all means climb the career ladder within to positions where your voice can matter.

If you’re unhappy with the choices available to you, go free agent or become an entrepreneur to claim your own business-political voice in the Business Discourse.

Somewhere between 2015 and 2019, a lot of people became unhappy with the choices available to them, but were apparently unwilling to pay any sort of significant personal cost, such as would be involved changing jobs, earning political capital within the company, starting your own business, or going free agent.

As a result, employee activism went from being part of the solution to the problem of executive excesses, to being a problem in its own right.

The general public now has two problems.

Starting around 2016, employee activism began taking over the Business Discourse entirely. It began drowning out all conversation around the actual role of businesses in societies: providing products and services, building wealth, and turning technological advances into prosperity.

Unlike traditional labor, which restricted itself to issues of pay and working conditions at the particular business, this new breed of activism is often driven by white-collar workers, and has a very broad range of political issues it is interested in. Also unlike traditional labor, it bizarrely acts as though the actual business mission of a business is irrelevant, and can be safely made subservient to a broad political mission without any significant loss of economic viability.

This will of course play out as it will play out. You may or may not agree with my views above, but the point is, the Business Discourse is a thing, and interesting shifts are happening within it.

Depending on your politics, executives might count as good, and activist employees as bad, or vice versa. But either way, if you’ll pardon the bad pun, free agents are the medium element.

The question for us here on this newsletter is: what role should the gig economy play here? What position should free agents attempt to occupy in the shifting Business Discourse?

Good, Bad, and Medium

I have already argued, in previous posts, that in the politics of the workplace, free agents are essentially scabs (see The Clutch Class from Aug 29, 2019, and Return of the Clutch Class, September 23, 2020).

Not surprisingly, they tend to be caught in the middle in the Business Discourse as well. What role do they play in shaping it?

In my June 11 issue earlier this year, The Way of the Mercenary, I wrote:

And while history is often written by both winners and losers, it is rarely written by the mercenaries who shepherd its less glorious chapters towards resolution.

This is of course a point directly relevant to us. The history of late industrial modernity may be written by/for/about the “kings and popes” of our time — CEOs and Presidents/Prime Ministers — or by/for/about the “commoners” (in the form of say the history of the labor or social justice movements), but it will not be written by/for/about consultants or freelancers. But as in the 1350s-90s, a post-pandemic period that very much resembles today, ours may in fact be the most significant role for a while, even if not recognized as such by the history writers.

Because freelancers today, as in the 14th century, are necessarily, definitionally, mercenaries. In the stories of history as written by winners or losers, it is the fate of mercenaries to be cast in a role that is worse than the good or bad guys in any account: shadowy figures who refuse to pick permanent sides, and subvert, through their very presence in the story, any claims to absolute rightness made by missionaries on all sides.

Then as now, mercenaries were simply outside of the false consciousnesses of the many mutually inconsistent missions they participated in.

How does this cash out in relation to the Business Discourse? It is clear what happens to executives and employees:

-

Executives like Brian Armstrong make politically loaded decisions and take on the attendant risks. Maybe key employees will leave. Maybe the product will suffer. Maybe enough customers will boycott the product to make a difference.

-

Employees might leave for other jobs, or to start their own businesses or gig economy careers. Or they might stay in good faith (accepting limits on their political voices at work) or bad faith (staying with the intent of somehow sabotaging the company).

Gig workers tend not to express their politics in either of these ways. By working for many clients, and shaping the scopes of specific gigs, they are able to hedge their political portfolios.

At the level of rideshare drivers, a driver who has two phones with Lyft and Uber apps open on them can make a choice at the level of a single ride which company to support. At higher levels, you can choose how much attention you give different clients, and what parts of gigs to say yes or no to.

One way to think of this is that that political allegiances of gigworkers are not monolithic. Through diversification, we can craft a better political voice for ourselves, at lower cost, than either employees or executives.

But the cost of this power is that we are more bound to the message of the medium.

Rideshare drivers must become both good drivers earning high ratings, and good at coming out on top in the arms race with the dispatching algorithm (for example, by choosing when to work based on peak and surge pricing times, and the types of routes available in different areas).

Web designers must keep up with evolution in standards. Programmers must keep up with trends in programming languages. Strategy consultants like me must keep up with broader technological trends.

They must, in other words, become messengers of their mediums. By voting with their tools, they contribute to the success or failure of different companies that share a technological base.

I for instance, have primarily been a messenger of the internet as a medium. A lot of my gigs over the last decade have basically revolved around the question of how to transform businesses in response to digital technology trends. More recently, I’ve become a messenger of sustainability technologies as a medium.

Being the messenger of the medium is not a trivial role. Often, it is the invisible but decisive role, over the roles of speaking for capital or community. Because individual businesses riding a technological wave might succeed or fail, but there is also an overall trajectory to the evolution of every medium, with a clear beginning, middle, and end.

To be the messenger of the medium is to be dominant in the endgame, when the nature of the underlying medium finally expresses itself with full clarity.

Media and Endgames

It is a commonplace observation that business sectors tend to be driven as a whole by the nature of the technological medium. In the opening, visionary companies tend to dominate. Medium effects are swamped by early path-dependence effects.

In the mid-game, fast-follower companies tend to grow and dominate the market overall (though the visionary pioneers may continue to dominate the narrative and enjoy a brand premium). Medium effects are swamped by mid-game capital effects.

In the end-game, as the technology fully diffuses and matures, low-cost leaders dominate the commodity phase, and medium effects finally rule.

Not surprisingly, the gig economy plays a progressively larger role as a sector matures, and more and more of the “medium intelligence” so to speak diffuses into the general economy. Startups typically hire few contractors and consultants. Late-stage companies typically have entire gig-worker ecosystems around them, shared with their industry peers.

Elsewhere in The Way of the Mercenary, I wrote:

Missionary beginnings showcase the aspirational best side of humans, but missionary endgames usually reveal the worst they are capable of. When missionaries grapple with each other in an existential struggle for dominance, they can lay waste to everything else.

Mercenaries are not heroes. But they don’t claim to be either.

Mercenaries are not virtuous, noble people. But they don’t claim any particular virtue or nobility either.

But often in history, they end up acting more heroically than people claiming to be heroes, and exhibiting more virtue and nobility in practice than missionaries.

And not because they are better people, but because they have no choice but to do what they must to continue the game to natural and logical conclusions, long after the missionaries have smugly declared victory, or admitted defeat, and gone home. Because unlike the missionaries, mercenaries typically have to live with the consequences of their actions. They have no safe havens to retreat to once missions unravel, but the fighting continues.

Today, we are in the long endgame of one of the longest technological eras in history, driven by perhaps the biggest business technology after the steam engine: the internet.

As messengers of the medium, free agents are often heard the least, but their actions often matter the most. In the Coinbase case, it is noteworthy that the cryptoeconomy — a late-stage internet sector — is strongly shaped by a large number of open-source projects and legions of freelance programmers.

It is unclear how the story of employee activism will unfold in the next few years. We are living through some of the most uncertain economic times in living memory.

But one thing is clear: there is a hugely powerful medium approaching maturity, and we are its messengers. To play our parts in the larger drama, we must understand the message of the medium better than anyone else. Others might start various games, but it is up to finish them well.