I was idly wondering earlier this week about the classic time-rich/cash-poor conundrum, when a question struck me that I’d never really thought to ask systematically and seriously.

Why can’t time-rich people live off time capital the way cash-rich people can live off money?

By the paycheck benchmark, you have 40 hours/week at 50 weeks per year, or 2000 hours of time capital per year, for the rest of your life. If you think you’ll live another 40 years, you have 80,000 hours of time capital.

You can do more or less risky things with it (devoting it to earning a paycheck is incidentally, not the lowest risk thing you can do with it, just the simplest thing logistically), and get higher or lower rates of return on your time investments.

Of course, you only get time at a rate of 24 hours/day, but then even the worst failsons typically don’t spend all their money on Day One after getting their trust funds. So though there’s a drawdown rate limit on time, it doesn’t actually matter for most things you might want to do with that time. So there’s nothing fundamentally impossible about the idea of time capitalism.

So I decided to do some very simple and naive math to investigate it, in particular ignoring ALL ruin effects (where you run out of time or money along the way), and inflation.

Living off Money

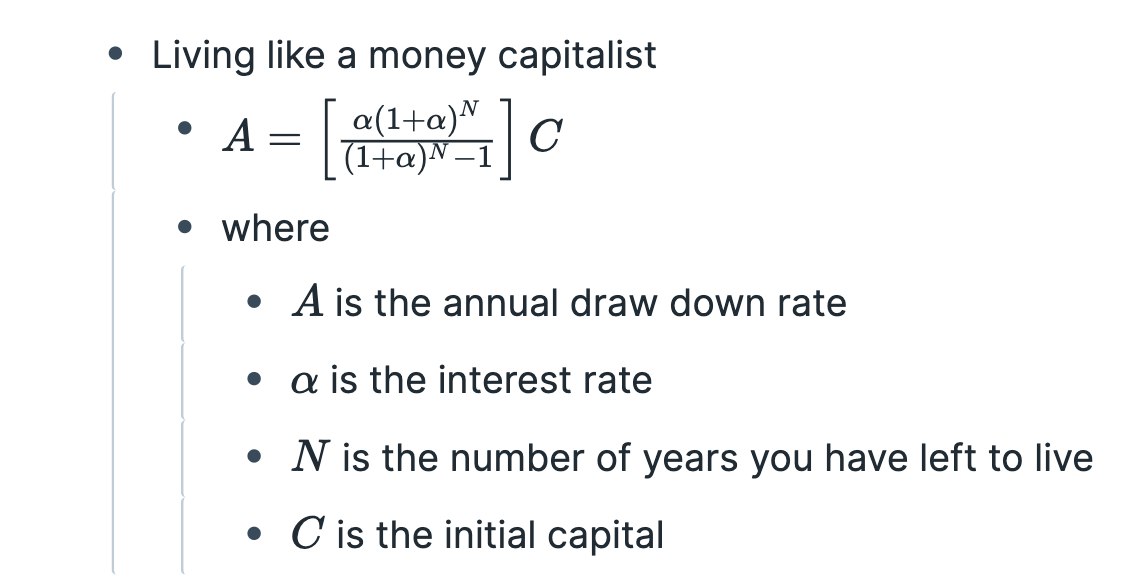

First, let’s look at money, because it’s more familiar. If you start with a certain amount of capital, and draw it down at a steady rate with the intention of dying bankrupt, you get this formula for the sustainable drawdown rate at various rates of return. I think I derived it right. It’s been a decade since I did this sort of math:

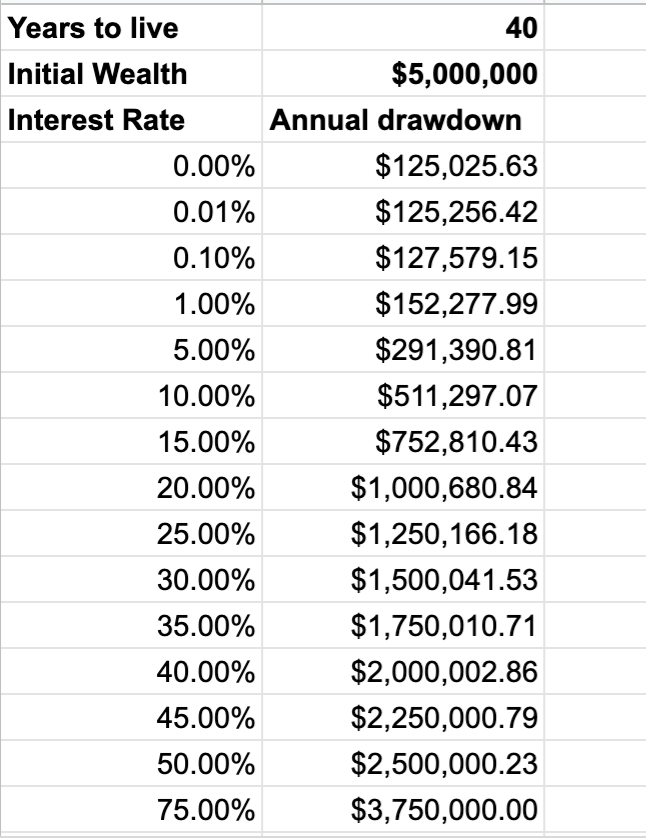

And here’s a screenshot of a spreadsheet (here’s the link, feel free to make a copy and play with it) showing the sustainable drawdown rate as a function of interest under some assumptions ($5 million initial capital, a typical fuck-you money target). The first row is actually not 0% but 0.001% (at zero the formula goes to 0/0 so you have to take the limit).

Obviously, if you have zero risk tolerance, your sustainable draw-down rate, ignoring inflation, is simply the initial amount divided by the number of years. The lower your risk tolerance, the closer you get to that limit. In this case, 125k.

Less obviously, the higher the return rate, the closer the drawdown rate gets to living off roughly the annual interest (it’s because as the interest rate and number of years go high enough, the 1 in the denominator can be ignored and the drawdown is approximately the interest rate times the initial capital).

But the basic point is, if you can invest at higher return rates, your drawdown potential goes UP dramatically, as does your risk of ruin. Conversely, if you have a target lifestyle that costs more than the risk-free drawdown rate, you have to take risks to balance the equation.

Note that I have not modeled running out of money along the way, which will obviously happen if your initial capital is too low and your drawdown rate too high. Non-ergodicity and Russian roulette are a bitch, that’s life. But if you stay away from the gambler’s ruin limits, the formula is good enough to get a sense of wealth dynamics and what it means to live off of capital.

So far, nothing special. This is the sort of math wealth management calculators do in much more sophisticated ways. But here’s the fun part. With a little bit of algebra, you can get a similar formula for the required intrinsic yield rate per hour on your time.

Living off Time

Caveat: this is the absolute dumbest, laziest model of time capitalism I could come up with. My narrative interpretation of the variables is doing a lot more work than the math here. Possibly a better version of this formula already exists in some economics textbook somewhere.

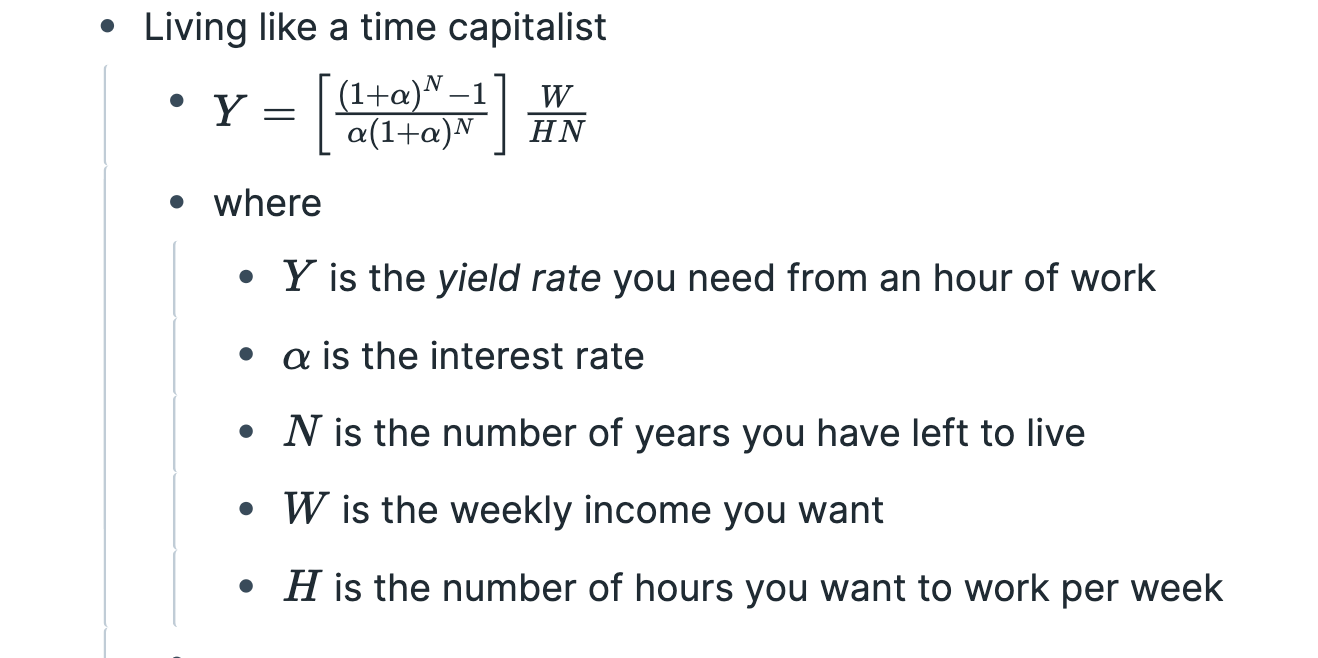

Here’s the formula:

As you’ll notice, the formula is just the previous formula with some re-arrangement and extra terms (initial wealth has basically been modeled as time left in life). Again, we’re not modeling running out of time or money, or the fact that you can’t actually invest more than 24 hours a day. The point here is to get a feel for this beast.

Here’s how to read it. If you want to hit a certain income target by working a certain number of hours per week, you need a certain intrinsic yield rate on your time that implies a certain level of risk. Here, “interest rate” is not return rate on capital, but a sort of “return rate on all the time you have left based on what you’re doing in this minute.”

Yeah, a janky interpretation, but it was that or more complicated math.

Think of it this way: to work with a 5% “interest rate” on your time is not about working harder, smarter, or more skillfully. It’s doing riskier things with that time. Being bolder basically.

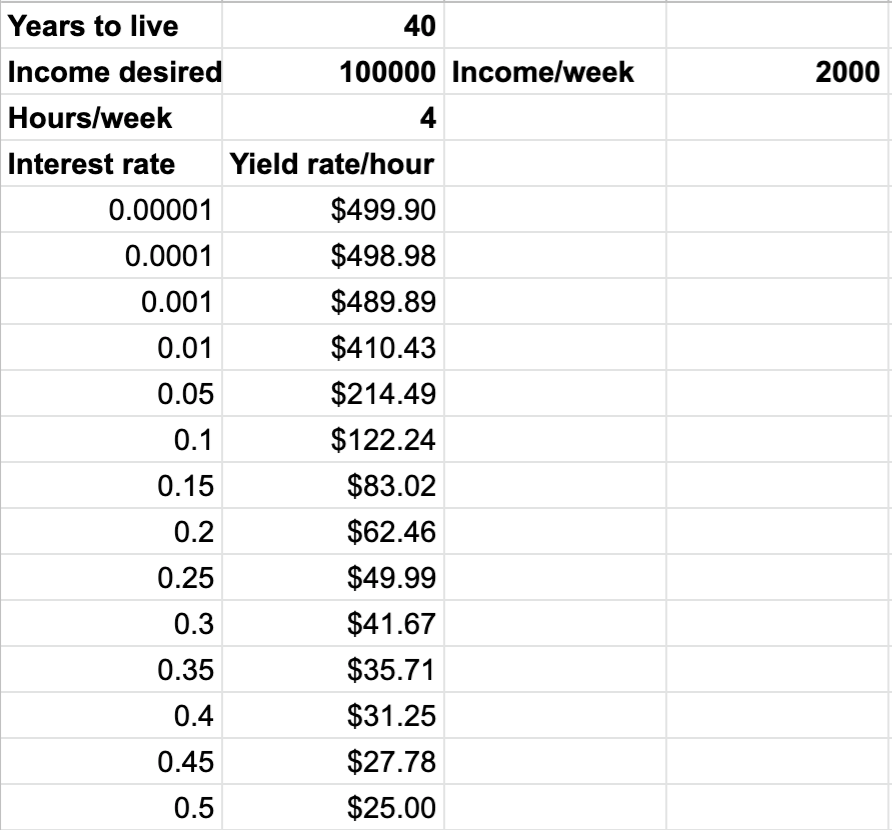

This time, the spreadsheet (tab 2 if you want to play with it) looks like this. Again the first row is not 0% but 0.001%.

Again, as expected, with zero risk tolerance, your yield rate/hour basically has to be your target income divided by the number of hours you’re willing to work. So in the example, if you want $2000/week and want to work 4 hours per week like Tim Ferris, well then, you have to make $500/hour for 4 hours a week for the rest of your life.

If there’s sufficient demand for your consulting services at that rate, and you expect to work till your dying day, you’re set.

But maybe your skills aren’t valuable enough in the market to command a $500/hour rate. Maybe you can only command $215/hour. But you’re lazy and don’t want to work more than 4 hours per week. So what to do if you’re both too dumb and too lazy to earn the lifestyle you want?

Well, you take risks and hope to get lucky. If you can’t work smarter or harder, you have to work bolder.

In this case, you’d better be taking 5% “interest rate” worth of risk with your time.

The return on that risk could show up in many different ways.

-

Maybe you build an asset that delivers a passive income stream or rent, like a published book or a small web app.

-

Maybe you don’t get any smarter or more skillful at what you do (quite possibly you’ve gotten dumber and less skillful), but people simply want to pay you a premium for the same work because you’ve somehow worked it so you add brand cachet. You’ve turned yourself into a rent-generating asset.

-

Maybe you simply live really frugally initially and invest much of your surplus, slowly converting time capital into financial capital.

Think of Y as the pre-risk “intrinsic yield rate” on your effort, not the actual return rate. The returns of working with a certain level of smarts and energy.

If that’s confusing, think of it this way — the effort/intelligence required to buy a stock is the same in terms of simply navigating the UI of the trading website, understanding what you’re looking at, and which button to press to complete the trade.

But if you get a bigger return simply by investing in a riskier stock with the same amount of research, and getting luckier, the “intrinsic yield rate” on your time is still the same. If you were doing it with someone else’s money as a paid professional, and they simply told you “invest in high risk stocks” as their intention, and took on all the risk, you could probably charge that intrinsic-yield-rate amount as your management fee.

“Management fee for managing your own time” is actually a good way to think about the intrinsic yield rate. There’s a risk-taker-you who sets the target risk level, and then there’s the manager-you puts in the effort/skill/intelligence to actually execute behaviors at that risk level.

The risk level you take on has nothing to do with the intelligence or skill level needed to correctly execute the actions required. Buying lottery tickets is about as skilled a job as taking out the trash. It’s just much higher risk/return.

But the fascinating thing is how quickly your required yield rate drops if you’re willing to take risks. If you take risks corresponding to a 25% return on your time, you can hit your target income rate at just $50/hour yield… averaged over a lifetime that is, not instantly.

Another way to think of it is how quickly the required smarts drops with increased willingness to take risks. Let’s say it takes a genius IQ to consistently get $500/hour for 4 hours/week with no risk at all. Well, take on risk corresponding to a 50% “interest rate” on time, and you can make the same at $25/hour level of smarts, which might be completely average, based on the risk-free jobs you could typically get that pay that much.

I’ll try to think of better math and a better interpretation, but I think the picture is already clear with this cartoon version.

The moral of the story is that taking more risks with the same amount of available time, skill, and intelligence makes a huge difference. It’s the essence of time capitalism.

Time capitalism is about understanding the effects of risk-taking with your time so you can work with time-rich/cash-poor conditions.

For those of us without a big pile of initial capital to draw down, it’s the only kind of capitalism open to us.