A recurring theme in this newsletter is that gig work is shadow work. One of the subtle consequences of this is that the gig economy is extremely fragmented and arbitrary in structure and behavior. Once you get past the broad 3-way distinction among indie consultants, contractors, and platformers, the detailed structure of the terrain is really hard to map out. Generalizations and narrative threads are for the mainstream paycheck economy. The gig economy is defined primarily by the glitches, exceptions, and incoherencies of the mainstream paycheck economy.

Our messy map is the reason their suspiciously clean map doesn’t fall apart.

The gig economy is the part that’s been swept under the rug. It is the set of patches for the mismatch between the map — the institutional landscape with its org charts and job descriptions — and the territory of economic reality. That’s why the gig economy is by definition also the shadow labor economy. And no part is more shadowy than the indie consulting part.

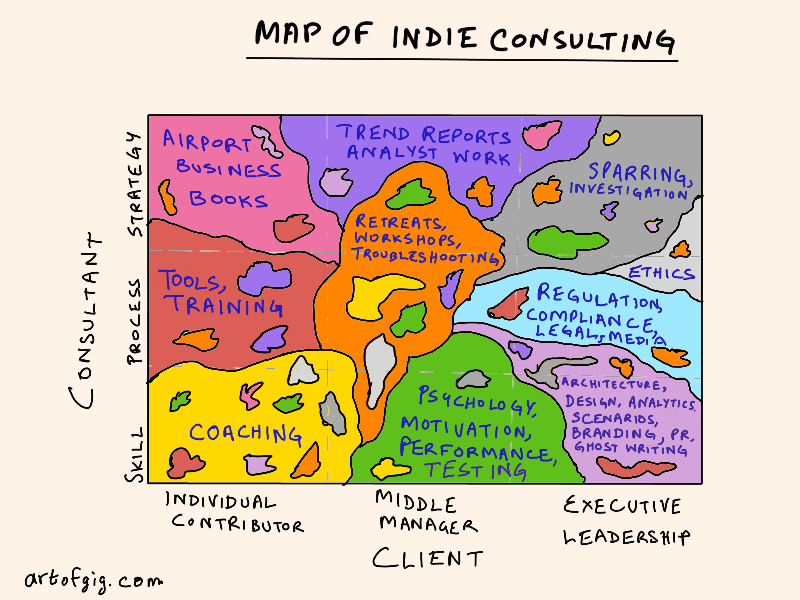

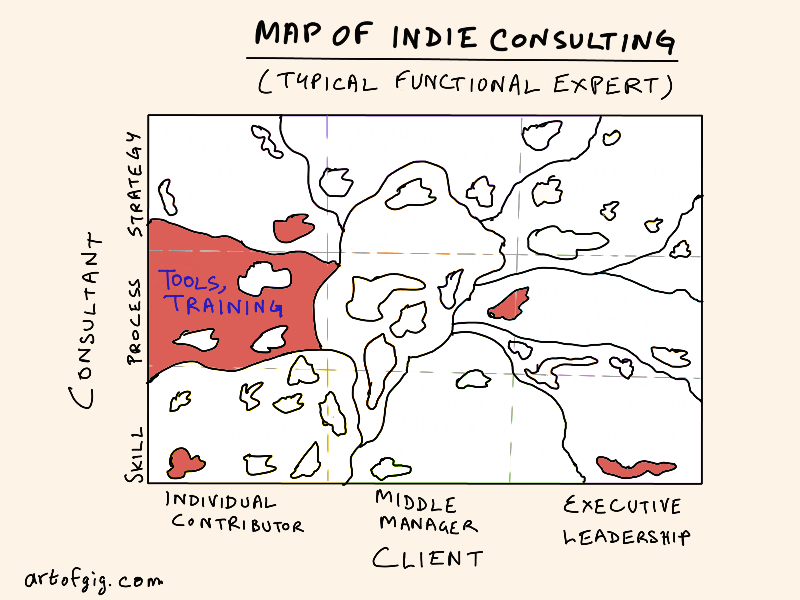

I took a shot at making a map of indie consulting as a shadow zone. This is a draft beta version that I intend to refine and label/annotate properly in future versions. It is meant to suggest broad contours, not exhaustively cover every sort of indie consulting you could do. I’ll explain the overall logic, and then drill down into a few of the markets to illustrate.

The map reflects the fact that indie consulting is the messiest and most shadowy of the three subsectors of the gig economy. Why?

-

The contracting subsector inherits the structure of the paycheck workforce via extension/augmentation. Every contractor in principle could be converted to a regular employee in a simple way by extending or re-scoping the org chart.

-

The under-the-API platformer subsector has a structure dictated by platform architecture and various algorithms that handle tasking and coordination.

-

But the indie-consulting world? No structural forcing function, but a great deal of shadow energy. Which is why you end up with a picture like the one above.

In the map above, the x-axis represents the level of client principal you serve, the main person you deliver to, who signs off on your work. The y-axis is the basic category of consulting offering: skills-based, process-based, or strategy-based. The distinctions are the obvious ones:

-

A skill is anything learnable that you can improve with practice, and acquire prowess at. If you can win a grade or excellence award at it, it’s a skill.

-

A process is anything that primarily needs some sort of basic procedural literacy, and conscientiousness, rather than talent to do well. If it doesn’t take much practice, and you can earn a certification for it, it’s a process.

-

Strategy is anything that relies on insight rather than prowess or conscientiousness. If you can earn an illegible reputation for it, but awards and certifications for it are cringe, it’s strategy.

Now the thing about this 3×3 grid — shown as light dashed lines — is that it’s tempting to identify each “square” as a clean-edged role you could play. Unfortunately for us, the gig economy does not allow for such clean boundaries.

Each of those squares is actually a typical paycheck role (likely occupied by your client). For example, executive leadership + strategy = CEO, executive leadership + process = VP, Human Resources, executive leadership + skill = CFO (I’ll leave the other 6 boxes for you to fill out as homework).

But our map is based on ways in which their nice map fails to actually cover the territory it is expected to cover. So each indie consulting niche is like a fragmented country on this map. It has a main coverage region, but also a bunch of scattered outposts.

There are 10 offering-based markets on this map, but I won’t attempt to describe all of them in detail, only the ones I have some experience of.

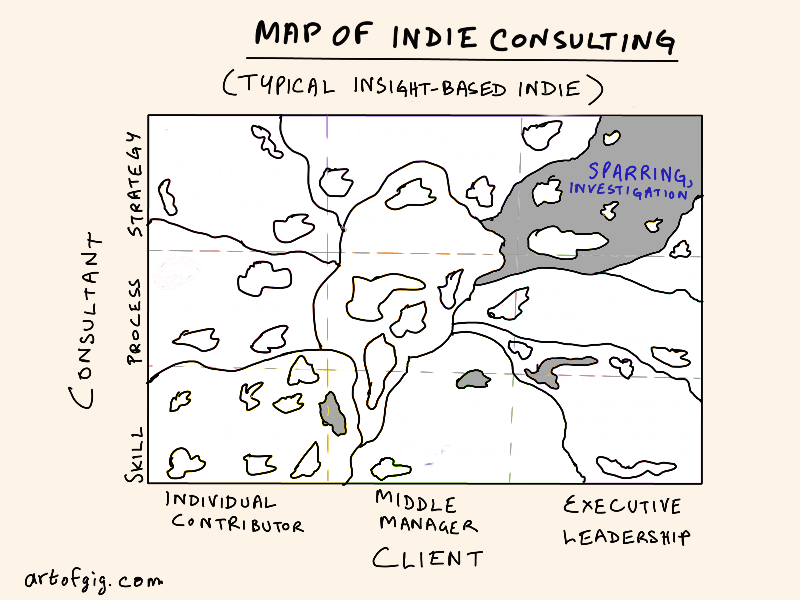

Insight-based Indie

I’ll start with my market. As an insight-based indie, mainly offering things that get labeled “strategy,” most of what I do is in the top right corner, and is delivered through 2 kinds of offerings: sparring and investigations.

But not all of what I do is in that corner, and I don’t cover all of the needs of that corner. There are isolated spots of sparring and investigation required in the “skill” row, and some bleed-over into the “process” row (for example, OODA-related things I do often bleed into the middle).

One of the reasons strategy offerings for executives is so dominated by “sparring” relationships is that leadership is famously and visibly a lonely, solitary kind of work. So the primary “shadow” need is actually intellectual company that can keep up. As a result, much of what is delivered in this corner is delivered through sparring style interaction, even though the content can be hugely varied.

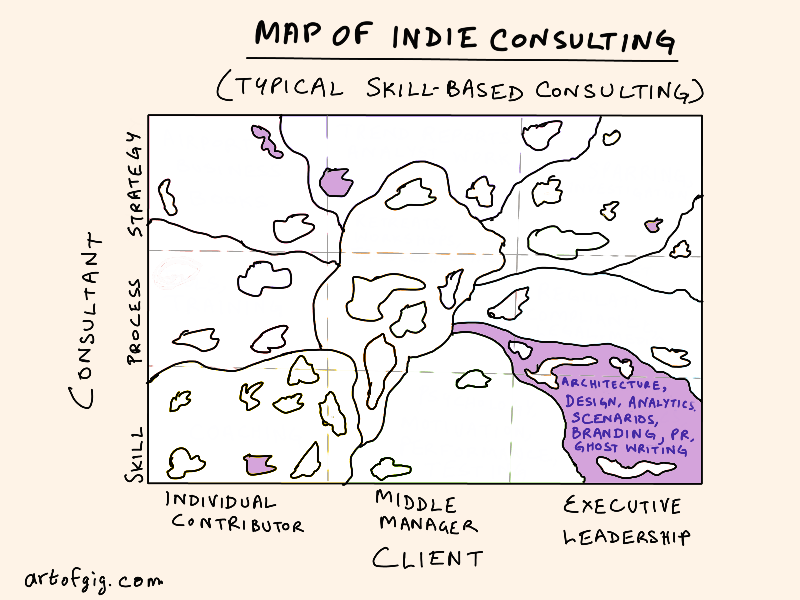

Skill-based consulting

This is probably the most crowded market on the indie consulting map, and the place where most younger entrants into the gig economy start out.

It tends to include anything that is adjacent to an individual contributor skill. I very rarely operate in this market, but when I do, I make sure it is something I deeply enjoy doing hands-on, and typically don’t bother about billing time accurately. I’m happy to spend more time on this kind of thing than the client might think reasonable, to get it right by my own standards and curiosities.

One way to think of this market is that it can be described via prefixes like pre-, post-, meta-, para-, or infra- attached to individual contributor paycheck employee roles.

For example, (software) architecture skills are a kind of meta-development (the real architecture part, not development title-inflated to architecture). So an actually skilled and experienced Scrum trainer would fit into this market.

Design skills are a sort of pre-product development skill. You won’t be doing all the detailed engineering or design work, but you might be crafting the broad approach and creating the design space for the adjacent employees to work with.

Often this kind of consulting builds up a foundation, capability, or starting condition in a short period and then hands it over to regular employees to run in production mode. Either that, or it is a transient “special projects” type need that does not need sustaining once it’s achieved its objectives.

Notably, you deliver via a skill, but not to the adjacent-role individual contributor paycheck employees who will eventually take over, or even their managers. For maximal impact, you must deliver to executive leaders who own the risks of the initiative (if you’re delivering to another locus, chances are, the project will fail).

Sometimes you can turn skill-based consulting into strategy content for individual contributors, via a blog post or a talk for instance, in the square dominated by business book writing. Other times, you might coach individual contributors briefly, especially in hand-off processes. But in general, you should be selling to executives, either to get some new risky initiative off the ground, or as a special project.

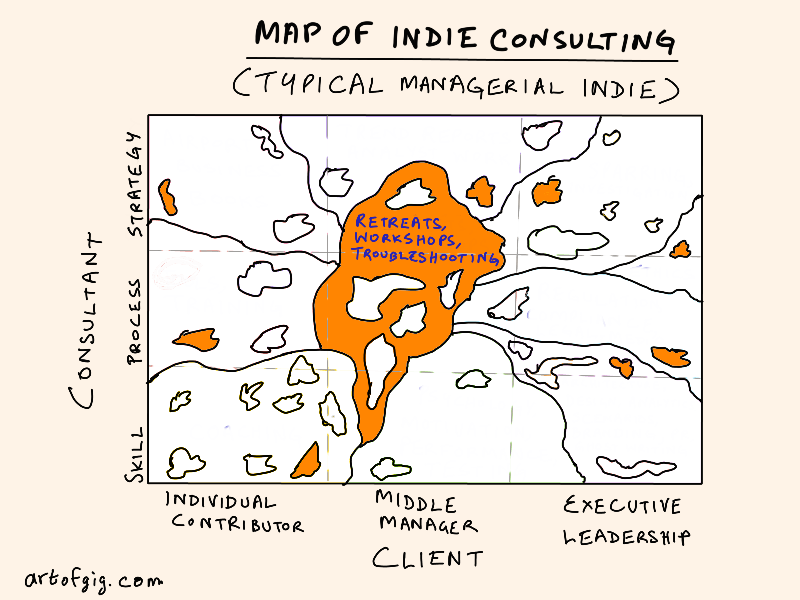

Managerial Indie

A harsh truth about hierarchical organizations is that the amount of room shrinks as you go up the corporate ladder. This means a lot of indies start out mid-career when they find they’ve hit some sort of ceiling and can’t get promoted, but are too bored or frustrated to remain at their current level. Or they’ve just been laid off. So they go sideways and turn into managerial indies.

Managerial indie offerings are typically things that require a degree of managerial experience and skill (and often based on something they first learned to do as an employee), but are primarily based on conscientious delivery. A dead giveaway is that you offer the same thing to many clients, with little to no modification. If it can be labeled a “best practice” it can be a managerial indie offering.

Stuff like workshops and retreats are the bread-and-butter for this kind of indie, and often this attracts the most bureaucratic types who crashed out of their paycheck careers through cluelessness. In the indie world, this cluelessness can sometimes turn into an asset, since it comes with an infectious enthusiasm that can charm clients despite being borderline cringe. On the flip side, on occasion, when clueless types clue up, they can often get radicalized and resentful, and turn to grift — and nothing is easier to turn into a grift than a managerial indie offering. They know how organizations work, and are pissed off enough at society at large to use that knowledge against the world.

As a result, a lot of managerial indie consulting work is offerings that are more theatrical and CYA than impactful. But when these offerings are crafted and delivered well, they can be very interesting to do, and valuable to get as a client.

I’ve done this sort of thing occasionally, but frankly I don’t enjoy it, and am not conscientious enough to do it well, especially repeatedly without much change. The exception is when it’s a workshoppy topic that lends itself to very high customization and context-dependent redesign for each client. So it’s essentially fun each time, and has strong skill or strategy components to it.

One special type of offering in this market is troubleshooting. Experienced managers who were once skilled individual contributors are often the best troubleshooters for tricky, highly specific problems that confound employees without the right experience. If this were a common type, it would be a market in its own right, but typically so few people do this well, they tend to present as regular managerial indies, but with a “fixer” or “bagman” footnote to their nominal reputations.

Functional Expert

Finally, there is the functional expert. It can be hard to tell this kind of indie apart from the managerial indie, since both are typically mid-career and process-focused. The difference is that the functional expert typically brings seasoned individual contributor abilities to the party, rather than managerial, and delivers to individual contributors rather than managers.

Often this involves experience with highly domain or industry-specific tools (such as SAP) that are not taught in schools, and have to be learned on the job. The presence of specialized tools means that compared to the manager-indie market, there is some resistance to bullshit. But don’t trust that too much. It is possible, just harder, to sell a lot of bullshit tooling, and training for that tooling.

This is a type of consulting I’ve never done (I have no relevant skills of this sort), and never want to do, but have seen close-up a lot.

One “tell” of this type is that they go to industry conferences a lot, and all know each other within a given geography or market. They are the most heavily networked of all indies, and present a guild-like brand. There’s a good chance they’ve authored an O’Reilly type book.

Other Markets

To wrap up, the 6 markets I didn’t cover in detail (due to a mix of limited knowledge and limited interest) are:

-

Coaching: Anything involving 1:1 soft or meta-skills training and mentorship for individual contributors that is typically not available in schools and can’t be learned from books alone. Coaching qua coaching is typically an early career market. So-called executive coaching is, I’m increasingly convinced, 90% either sparring, or therapy in disguise. The rare specialized coaching you need at executive level, such as media-training, is usually procedural rather than strategy or skill-based.

-

Psychology, motivation, and testing: Highly adjacent to the managerial indie market, but with a bigger skill component. Stuff like non-violent communication, motivating employees, active listening, Myers-Briggs. You can often earn premium-mediocre credentials in this market that are somewhere between certifications and actual hard skills.

-

Trend report/analyst work: This is probably the most legible kind of indie consulting work and is the most “researchy” kind of offering. It also has the biggest moat for indies, since it takes serious time, effort, and network capital to produce. Which means you’re most likely to get this kind of work via an intermediary analyst firm. Or you burn up savings producing it on spec, hoping to sell it once you’re done.

-

Regulation, compliance, legal, media: Self-explanatory. Any kind of indie consulting that involves pragmatically navigating an arbitrary and complex external maze. Unlike the adjacent workshops/retreats market, this market is created by 3rd parties like the government or media forcing your clients to do something.

-

Airport business books: It is hard to sell “strategy” offerings to individual contributors because of the impedance mismatch. Strategy work costs time and money to produce. That’s why you can bill 4-10x as much for sparring work as for coaching work, and why analyst reports go for thousands of dollars. The only way to make money off individual contributor interest in strategy matters is via a mass product: a book typically. But this category includes anything that can be sold indefinitely via distribution (including recorded workshops, materials, and workbooks).

-

Ethics: I’m breaking this out as a separate market even though it’s tiny and usually absorbed in one of the adjacent markets (sparring if you want to think seriously about hard ethics conundrums, compliance if you just want to comply with the letter of ethics regulations enforced by the government or other external party).

There is a lot to be said about all these markets of course, and my own direct experience of most of them is fairly limited. As I said, I’ll be refining this map, and perhaps in the future inviting guest contributions to cover parts of it where I’m weak.