In the first two parts of my ±10 years look at the evolution of the gig economy from my own 10-years-in perspective, I looked at the 2 lowest layers of the stack: workflows and trust. The third layer is what I think of as the money layer. It is for free agents what the management layer is for the paycheck world.

What did the money layer look like in 2011? What does it look like in 2021? What might it look like in 2031?

These are not the questions you might think they are. It’s not about your money, but about money in general. What is it? Where it is? Who controls it? Where is it going? How does it flow? How is its fundamental nature changing?

You should be curious about these questions, independently of what seems to be the main selfish question: how to get some of it?

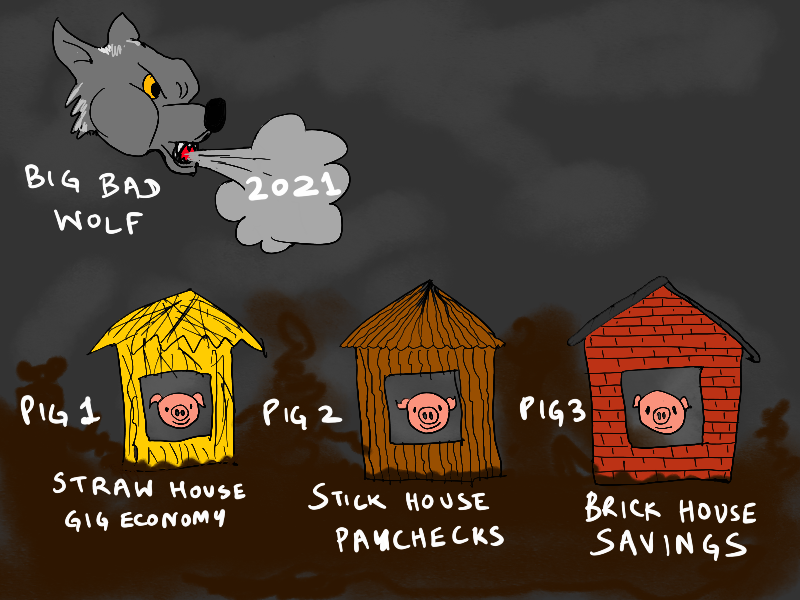

As a free agent, you live dangerously at the assembly language and API level of money, not safely at some high-abstraction level. You can’t afford to have the passive, disinterested (or even slightly contemptuous) attitude towards money paycheck people often have. If you don’t develop what I call a “money-positive” attitude, you risk both failing to make money, and developing unhealthy and fearful attitudes towards it. Just as, if you’re an employee, if you don’t get past disinterest and contempt and develop some curiosity about management, and a “management-positive” attitude, you’ll fail to advance. You’ll be reduced to seeking solace in Dilbert cartoons.

So you can’t treat money as a spectator sport. You have to develop a genuine, intellectual curiosity about money that goes beyond your personal needs.

But I don’t mean the kind of interest that bankers and investors have. I mean the sort of interest detectives and forensic accountants bring to their work. Like them, you can follow the money as a source of personal economic intelligence to guide your gig economy activities.

Following the money means understanding money the way you understand the weather and climate.

The weather is the low-level details of transactional flows, while the climate is high-level macroeconomic shifts. Each by itself can be misleading, but together, they can help you follow the money.

Let me illustrate with myself as an example.

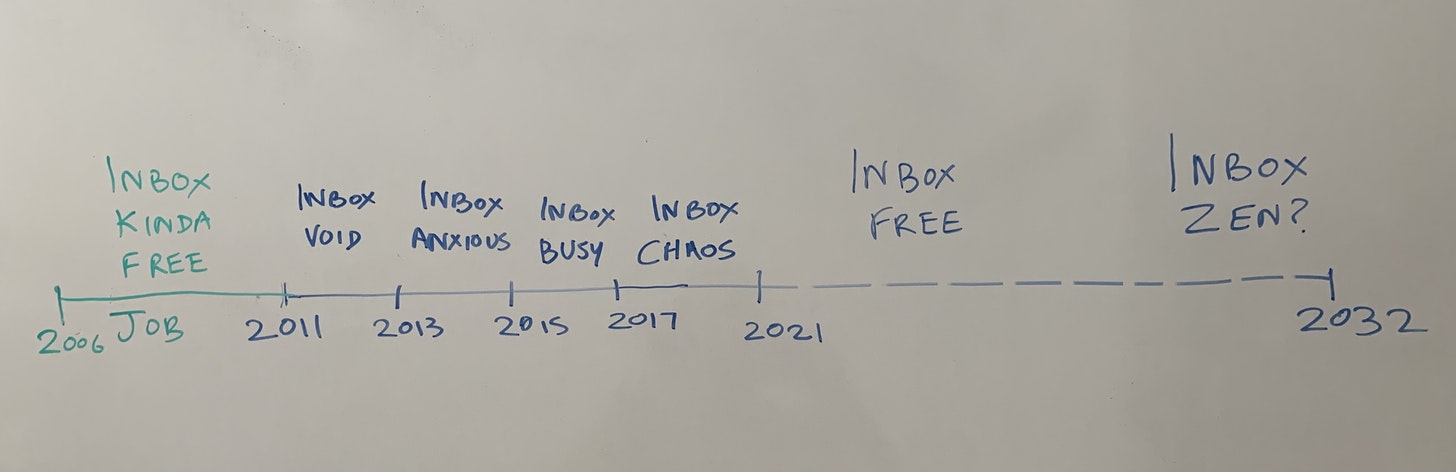

Money Weather, 2011-21

If you’re primarily used to getting money via direct deposit, and spending it via checks and credit cards, with things like PayPal and Venmo being “play money” on the side, the transactional complexity of the open economy can come as a shock to you. It’s as different from the paycheck money-flow world as outdoor weather is from indoor weather (to continue our parallel, management activities inside companies are like indoor weather control — adjusting the HVAC system and so on).

One of the most interesting ways to develop intuitions about following the money is to pay attention to how you’re paid at the level of transactional details, learning why things work the way they do in different industries, and developing preferences for being paid in certain ways. It’s like picking the sort of weather that suits your temperament.

Early on, you should aim to get paid in as many different ways as possible, so you learn about weather patterns and develop a sense of how they might be shifting. And you should always be willing to experiment being paid in a new way, unless it looks illegal or scammy.

Tracking how you are paid is to money what going outside and looking at the sky is to the weather. It reveals a lot about the client, the industry, and the local economic culture. Tell me how you are paid, and I’ll have some pretty good guesses about what sort of gig-work you do, and in what part of the economy. You probably can guess better than you think as well.

See if you can infer the “story” behind my history of payments below.

The first time I got paid, it was via paper check. I was paid mostly with paper checks for the first couple of years (and conscientiously saved the paper stubs like they were trophies). At some point, I got paid against a “purchase order” (PO) for the first time. And also got paid late via an invoice that somehow got “lost” for the first time.

At some point, most clients started paying via credit card. Even though I was set up to receive credit card payments from the beginning, it only became popular a few years in, reflecting changes in the infrastructure, environment, and who I was working for.

At some point, wire transfers started becoming more common, initially for international clients (and I had to get used to SWIFT codes), and then domestic. Sometime around 2013-14, payment via services like bill.com started becoming common.

For a gig in 2017, I was supposed to be paid in crypto tokens, but the company kinda “forgot” and since it was a small amount I didn’t bother pursuing it. I think that was also the year I received a paper check for the last time.

One big company I have worked with for the last 4 years has a really solid and futuristic self-serve automated model for dealing with POs and payments that I genuinely love. Once I year I do a big invoice with them, and immediately get an email from a partner firm called C2FO, offering immediate payment (instead of in 60 days) in exchange for a small discount that they calculate based on current economic conditions. It feels very futuristic. I’ve never had to avail myself of the discounted early payment offer, but it’s nice to know it’s there. It’s like high-end payday loans (and unlike payday loans the rates are reasonable). More such mechanisms are coming online.

One time, I was paid for an hour of consulting with… a pair of shoes.

This year, for the first time, I am accepting part-payment in stock options for a gig. It’s not an uncommon thing to be offered, but it is uncommon for the offer to be worth the trouble to accept.

I’ve paid a lot of my own subcontractors via PayPal, but can’t recall an instance of accepting money via PayPal. I feel that makes me part of the gig-economy middle class. PayPal has become something of the working-class transaction layer. It’s fine for occasional gig-economy dabblers, but a PITA for full-timers. Real indies use Freshbooks and integrate with Stripe. Using PayPal marks you as not quite serious.

Stripe has been a huge game changer in the plumbing of the middle-class free-agent world. It set up a whole parallel universe of financial plumbing, and a big chunk of my consulting income, and all my non-consulting income began flowing through it at some point.

Stripe and Paypal now also offers loans against cash flow analytics, without the bureaucracy associated with getting lines of credit at traditional banks, or the high interest rates of credit cards.

I never noticed it while it was happening, but the landscape of financial flows has shifted slowly but decisively under my feet, to become more automated, more electronic, more seamlessly international, and with much better risk and credit management. And at all scales from POs worth tens of thousands of dollars, to small transactions on the order of $5. Even for solo free agents, the cost of capital has come down sharply, though I’ve never needed it (nothing I’ve attempted to do so far has required any capital outlay bigger than the cost of a computer).

It’s almost like when I started out, it was in a primitive financial wilderness, and now it’s a well-paved urban built environment. In part, I’ve moved to a better corner of the economy. In part, the economic environment has changed.

Why is it important to pay attention to these things? Because often you get early warning about where things are headed based on these low-level details.

And often, the mechanics of transacting with a company can give you clues about its economic destiny (if you’re curious about why, look up Coasean economics). In 2021, you should be eager to work with companies that pay you in sophisticated, low-friction ways, and be wary of ones that involve a complex exchange of physical paperwork and end up mailing you a paper check. Following the money means following lower transaction costs.

Can you tell from the details above what the higher-level story of my money-making evolved? It’s like tracking someone through the woods based on footprints.

Money Climate, 2011-15

If the transactional environment is the weather, the macro-environment is the climate. To follow the money thoughtfully, you must pay attention to both.

In 2011, when I went free agent, the world economy was just beginning to limp out of the global financial crisis (GFC). At least in the United States, money was not yet flowing freely through the economy. Corporate budgets were still tight, with restrictions in place. In 2011, it seemed obvious that despite the “recovery,” the GFC had changed the world in very significant ways.

Banks had just been bailed out, and the economy was getting used to weird new phenomena like “quantitative easing” distorting the money supply in ways people were still not used to.

Silicon Valley had only recently started recovering from the effects of the dotcom crash a decade earlier, with a new wave of “2.0” companies that was yet to demonstrate viability. People were wondering: would it create another bubble and crash, or was this a more sustainable arrival?

I asked myself: Where is the money?

Specifically, the discretionary, liquid money that was not already spoken for, and might be available for me? The answer I came up with was:

-

Governments had money

-

Banks had money

-

A few big old companies had money

-

Silicon Valley had money

-

Ordinary individuals had some money

Straight off, I decided I was never going after government money via things like grants. Governments always have money, but it is always painfully hard to get at any of it. And it always comes with vast amounts of baggage, but few interesting risks you can meaningfully participate in. I might be willing to jump through a few hoops for a government gig at unique places like say NASA, but that’s it.

I also decided I was not going to go after individuals (via business models like personal coaching). As an established blogger, I had an advantage in reaching ordinary individuals, but “consumer consulting” was not really a meaningful idea in 2011. Neither the infrastructure, nor a culture of individuals paying individuals in their private capacity for consulting-like services, really existed back then.

There was no “direct to consumer” market in consulting, so to speak (this would change). Consulting was something you sold primarily to businesses above a certain size.

That narrowed things a little. I was after open-market, private sector money. But that was still too broad. I also decided that while I would be open to old economy and financial sector money, I would not pursue it.

That left Silicon Valley, or “tech money.”

I’ve been associated with the scene for a long time now, and am generally considered a “tech insider,” so this might seem weird, but in 2011, coming from the East Coast, this was not an obvious move. As a mechanical/aerospace engineer by training who had worked at Xerox, it was by no means the obvious conclusion that I should head towards the tech scene on the West Coast and try to find a foothold there. I was already 36 at that point, so not exactly young.

But in 2011, it seemed obvious that software was going to eat the world, and that the tech economy was slowly going to turn into the whole economy.

It was equally obvious that old economy companies were either going to go into decline-and-harvest mode, or into fraught “digital transition” attempts, most of which would fail.

Which meant, whether or not I had anything to offer, I had to position myself primarily in relation to Silicon Valley. That’s what following the money meant in 2011.

I did it physically. First we moved from Washington, DC to Las Vegas in the summer of 2011, and then from Las Vegas to Seattle (aka Silicon Valley North Annex) in 2012, after briefly considering and rejecting the Bay Area proper.

My bet paid off. Being located on the West Coast put me right next to the biggest, most free-flowing rivers of money in the world at the time. I began getting and closing more leads, mostly from tech companies, though not necessary on the West Coast — people from everywhere involved in tech tended to pass through all West Coast cities frequently back then. If you think of potential clients with money to spend as walking around with dollar signs on their foreheads, in 2011-15, they were all constantly passing through Seattle and the Bay Area (Portland and Los Angeles developed as significant tech hubs a little later).

I also learned a few things:

-

Startups were eager for consulting help but had little to no money

-

Growth-stage companies had money but were generally not operationally set up to handle consultants outside of very specific, targeted “special ops” needs

-

Large tech companies generally had anti-consultant cultures, unlike large East Coast old economy companies.

-

Investors had money, and were open to spending it on consultants

It took a couple of years, but I eventually developed enough of a strong network (see my previous newsletter) that I was able to plug in to the money flows of the tech economy fairly reliably, if not predictably. By 2014, I had worked for small startups, medium startups, large companies, and investors.

I was inside the tech scene, and perhaps more importantly, seen as being inside the tech scene. I had followed the money to its source.

Money Climate, 2015-20

Sometime around late 2014, I sensed a disturbance in the force. Flows of money were beginning to shift around me… again. Specifically:

-

Private equity (PE) money was becoming a bigger deal in tech

-

High-Net-Worth Individual (HNWI) and “family office” money was growing fast

-

The big platform companies were starting to behave like old companies

-

Investment money was pooling at the extremes — seed money, or growth money, with the middle slowly starving

-

Money was starting to seriously flow into climate and sustainability tech

-

Software was eating healthcare and bioscience, creating another large flow of money to follow

-

Money outside of Silicon Valley wanted to be like money inside Silicon Valley

-

Ordinary individuals had money and there was growing infrastructure to get at it

While I didn’t specifically try to follow these shifts in an explicit way, I began to keep an eye on them and staying informed, and saying yes and no to gigs in ways that reinforced my exposure to flows I wanted to drift with.

Often, the biggest source of intelligence was the mix of leads I was getting, whether or not they turned into gigs. After factoring out the effects of my own evolution, the rest was priceless intelligence about the economy.

Towards the end of 2015, I began consciously following the evolution of the sustainability and energy sectors, and thanks to a couple of new gigs, was able to start following that trail. To a lesser extent, I began following money in healthcare, and landed a few gigs in healthcare tech as well. That’s on the back-burner for now, but I might pursue it more actively in the future as it gets more interesting and moneyed.

Today, I say yes to tech gigs only if they are technologically interesting, and trying to push computing frontiers in somewhat fundamental ways. I no longer like gigs that simply run known Silicon Valley playbooks against new opportunities, or push existing technologies in incremental ways. I’m more likely to say yes to climate and energy gigs — that’s a big flow of money that’s only getting bigger with every passing year, but the sector also interests me because it is doing some of the most technologically interesting work happening today.

I used to be wary of PE money, and would often treat PE-funded status as a red flag in leads, but have grown increasingly comfortable with it. There’s PE and there’s PE. There’s the vultures, and there’s the bold turnaround operations. Some of the most interesting things these days happen neither at public companies or venture-funded companies, but at PE-funded companies.

And boundaries between PE, VC, and ordinary corporate money have started to blur anyway.

Money Climate Change, 2021-31

In the next decade, once again I sense vast shifts in the offing at both the weather (transactional) and climate (macrotrend) levels.

As I mentioned earlier, this year, for the first time, I accepted part payment in stock options for a gig (generally a bad idea — if they’re offering equity participation to consultants, it is unlikely to be a good startup).

One of my clients just IPOed via a SPAC.

One of my larger clients last year was some strange hybrid of a VC firm, PE firm, and family office.

The world’s financial hydraulics are changing yet again, as they do every decade or so. Never a dull moment when you live in the open economy.

The post-Covid economy is going to be… weird. In ways I can’t yet see. I feel like a beginner again, as should you.

The West Coast is also going through some sort of cyclical maturation late stage. “Tech” is getting dispersed around the globe, so it is harder to see what it means to “follow” the tech money. Life was simpler when you could simply physically move to where the action was. On the other hand, online pathways have become much better. Media like Twitter and now Clubhouse offer ways to “follow the money” virtually. In 2011-15, the “VC blogosphere” was a big deal, but that’s pretty much dead now.

The “Direct to Consumer” market, which in 2011 I dismissed as not a real thing, has finally emerged. With Stripe, and the “creator stack” of the “passion economy,” you can now sell things that look and feel kinda like consulting directly to consumers (or employees acting in their private capacity, with or without corporate reimbursement). This newsletter, arguably, is me selling consulting in an aggregated way to individuals, in a form factor that would have been highly inefficient 10 years ago. Depending on what you teach, online courses can be a form of consulting.

The cryptoeconomy also shows signs of maturing, and evolving from primarily an investment sector to a transactional sector. Expect to get paid in usable tokens in the next few years, and it being not such a weird thing.

Will I have to pack up and move physically once again, following the money? I will almost certainly not stick around in Los Angeles more than a few years. But where to next?

I don’t yet know. But this time, it will only partly be about following the money.

As I’ve grown somewhat more financially secure, I now have some freedom to solve for things besides money. That could of course change in an instant. All it takes is a few bad quarters, a major economic crisis, and some bad luck to go from feeling like you’re in a secure position to feeling like the world has collapsed around you. It’s happened before in my lifetime, and it will happen again. You think you understand the weather and climate, and then get blindsided like Texans did last week.

There is no permanent security to be found in the money layer of the world, but there’s always interestingness, and a general curiosity about money — but short of obsessive maximizing tendencies — tends to pay off. It’s part of our world, and it’s an interesting thing that rewards study both intellectually and by flowing towards you.

Money flows are never still. While ancient rivers of money always keep flowing robustly, they do change course slightly. But new rivers of money are always emerging, and fragile ones drying up. And the nature of money keeps changing.

In absolute terms, the oldest rivers tend to contain the most money by volume, but also the least money in terms of accessibility. Money in ancient rivers tends to be very stable and spoken for, and requires a lot of work to access. Money in newer rivers is easier to access, but is also liable to shift suddenly on you, so you have to stay on your toes.

Following the money has been quite the ride for the last decade. I expect it to be even more of a ride for the next decade.